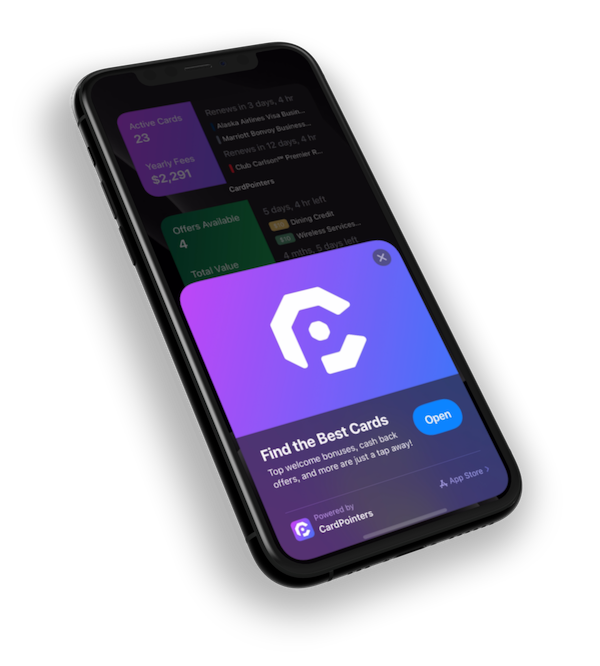

Most banks and financial institutions offer their customers a credit card app to conduct transactions seamlessly. Here are some unique features offered by the app.

- Easy Navigation

When it comes to a credit card app, there is a lot of information that you may want to know. With clear navigation, you will know where to find the details such as card transactions, monthly statements, card benefits, redeem rewards and security on the app. A mobile banking app is well-structured and intuitive. It enables the users to easily navigate and visit the appropriate screen for information. The best bank credit card app offers tabs with clear names to help you move from one page to another seamlessly.

- Availability of Information

All the important details regarding your credit card account are displayed on the app if you want them. For instance, you can know the total amount due on your credit cards, minimum amount payable, due date, credit limit allowed and interest charged. To access the information, you have to click on the relevant mobile banking app and log in using your username and password or fingerprint or MPIN. After that, you need to click on the ‘Credit card’ icon to find the linked credit cards and select the card. Then, click on the ‘Download statement’ option and select the time period from the options and download the statement.

- Quick Payment Options

With a well-designed credit card app, you can pay your credit card bills instantly anytime and anywhere. The efficient credit card net banking mechanism allows you to follow a few easy steps like clicking on the ‘Credit Card’ option, choosing the card and paying the credit card bill. Here are some quick payment options offered on the app:

- Net Banking: Whether you are an existing user or a new user of the app, you can make credit card bill payments by logging into the app and choosing the credit card and credit card bill and paying it after verifying the OTP or one-time password.

- UPI Payment: You can also pay through UPI BHIM app by clicking on the UPI option and then, on ‘Send money’. It will ask you to enter the 16-digit credit card number. Next, you need to enter the amount you want to pay and proceed with the payment.

- IMPS/NEFT Payment: This instant fund transfer method through NEFT or IMPS can be made by giving the credit card details and the bank name and IFSC code to make the bill payment.

- Reward Details

Your credit card usually comes with a lot of benefits and offers on travel, shopping, dining, movies, and so on. For every purchase or spend, you earn reward points. A banking app helps you log into your account and show your latest reward points and redeem them conveniently.

- Safety Features

A credit card application comes with numerous safety features. They protect your credit card information through encryption. Moreover, the app also allows you to lock your card if it is stolen or lost. You need not wait until you speak to a customer service executive.

When you log into a credit card app next time, check if you have the above features.

Mastering Online Masterclasses: Choosing the Right Online Violin Instructors

Mastering Online Masterclasses: Choosing the Right Online Violin Instructors  Empowering Healthcare Professionals: How WT Farley Oxygen Regulators Enhance Patient Care

Empowering Healthcare Professionals: How WT Farley Oxygen Regulators Enhance Patient Care  Elevate Your Collection: Unveiling the Beauty of Custom Wine Cellars in Ottawa

Elevate Your Collection: Unveiling the Beauty of Custom Wine Cellars in Ottawa  Enhancing Your Online Presence with Real Estate SEO Services

Enhancing Your Online Presence with Real Estate SEO Services  The Epitome of Luxury: Elevating Spaces with Imperial High-End Kitchen Cabinets

The Epitome of Luxury: Elevating Spaces with Imperial High-End Kitchen Cabinets  Pokémon go accounts- Exploring the reasons behind player demand

Pokémon go accounts- Exploring the reasons behind player demand  Pokemon go shortcut to greatness – Buy now

Pokemon go shortcut to greatness – Buy now  Online slot games for classic fruit machine lovers

Online slot games for classic fruit machine lovers  Ensuring Security In Online Fund Transfers: Understanding Fraud Prevention And Risk Mitigation

Ensuring Security In Online Fund Transfers: Understanding Fraud Prevention And Risk Mitigation